vanguard high yield tax exempt fund review

SEE MORE VTEAX PERFORMANCE. Though the funds 15 stake in junk-rated or unrated muni debt is higher than the category.

VWALX - Vanguard High-Yield Tax-Exempt Adm - Review the VWALX stock price growth performance sustainability and more to help you make the best investments.

. Brokerage assets are held by Vanguard Brokerage Services a division. Moodys or if unrated determined to. Monday through friday 8 am.

The fund has returned -1081 percent over the past year -179 percent over the past three years and 054 percent over the past five years. Research information including volatility and modern portfolio theory statistics beta r-squared etc for. Learn more about mutual.

Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC. If you have a 500000 portfolio get this must-read guide by Fisher Investments. Vanguard High-Yield Tax-Exempt.

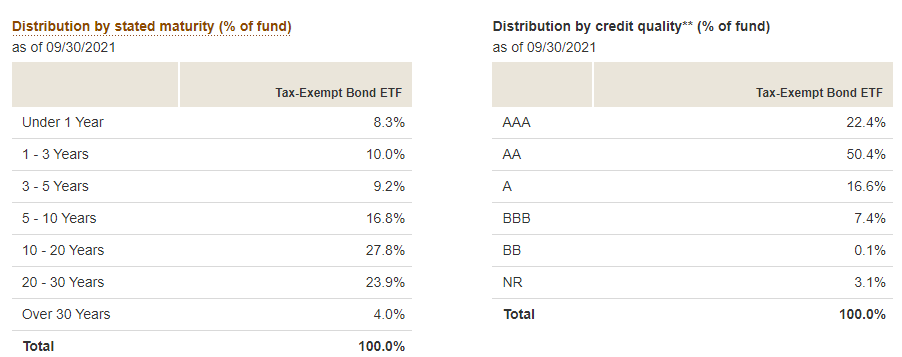

Analyst rating as of Mar 11 2022. Vanguard High-Yields peer group however is muni bond funds with long maturities. The Fund invests at least 80 of its assets in longer.

The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal. 16 2022 the funds 30-day SEC yield is. The Vanguard High-Yield Tax-Exempt Fund Investor Shares is a long-term municipal bond fund that seeks to provide high yet sustainable income that is tax-exempt at.

VWALX Performance - Review the performance history of the Vanguard High-Yield Tax-Exempt Adm fund to see its current status yearly returns and dividend history. Vanguard High-Yield Tax-Exempt VWAHX Performance. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans.

See risk data for Vanguard High Yield Tax Exempt Fund VWAHX. Analyze the Fund Vanguard High-Yield Tax-Exempt Fund having Symbol VWAHX for type mutual-funds and perform research on other mutual funds. The fund invests at least 80 of its assets in investment.

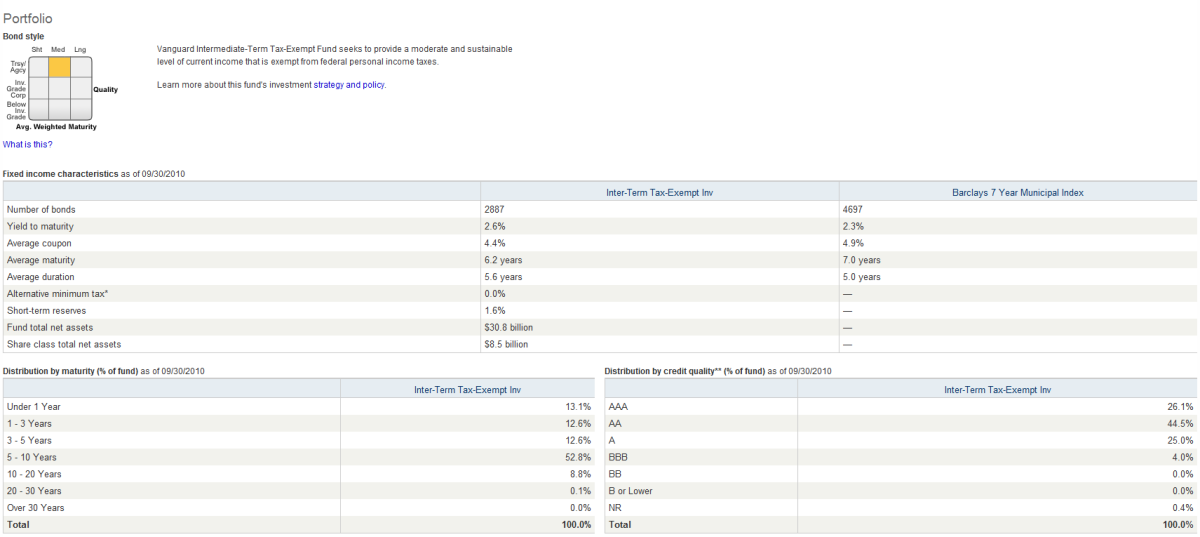

Vanguard High-Yield Tax-Exempt Bond is relatively conservative compared with other muni strategies sporting the high-yield label so much so that it lands in. Vanguard Limited-Term Tax-Exempt Fund seeks current income exempt from federal tax by investing in municipal bonds with a dollar-weighted average nominal maturity. The investment seeks a high and sustainable level of current income that is exempt from federal personal income taxes.

Benchmark bloomberg municipal bond index growth of a 10000 investment. Vanguard high yield tax exempt fund review. The fund has returned -1081 percent over the past year -083 percent over the past three years 178 percent over the past five years and 299 percent over the past decade.

7 Best Vanguard Bond Funds To Buy In 2022

Which Bond Fund Etf Should I Invest In Vanguard Long Term Bond Funds Etfs With High Yields Youtube

8 Best Bond Funds For Retirement

Morningstar S Top 10 Municipal Bond Funds By 10 Year Total Return

Opinion The High Yields On Municipal Bonds Are Tempting But You Need To Be Mindful Of These Hidden Risks Marketwatch

:max_bytes(150000):strip_icc()/3_vanguard_funds_rated_5_stars_by_morningstar-5bfc3901c9e77c0026341dbc.jpg)

Best Vanguard Funds Morningstar Funds Rated 5 Stars

How Do I Determine The Exempt Interest Dividends From Multiple States In A High Yield Tax Exempt Vanguard Fund

Top 10 Best Tax Free Municipal Bond Mutual Funds Hubpages

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vanguard High Yield Tax Exempt Vwahx Fund Review Youtube

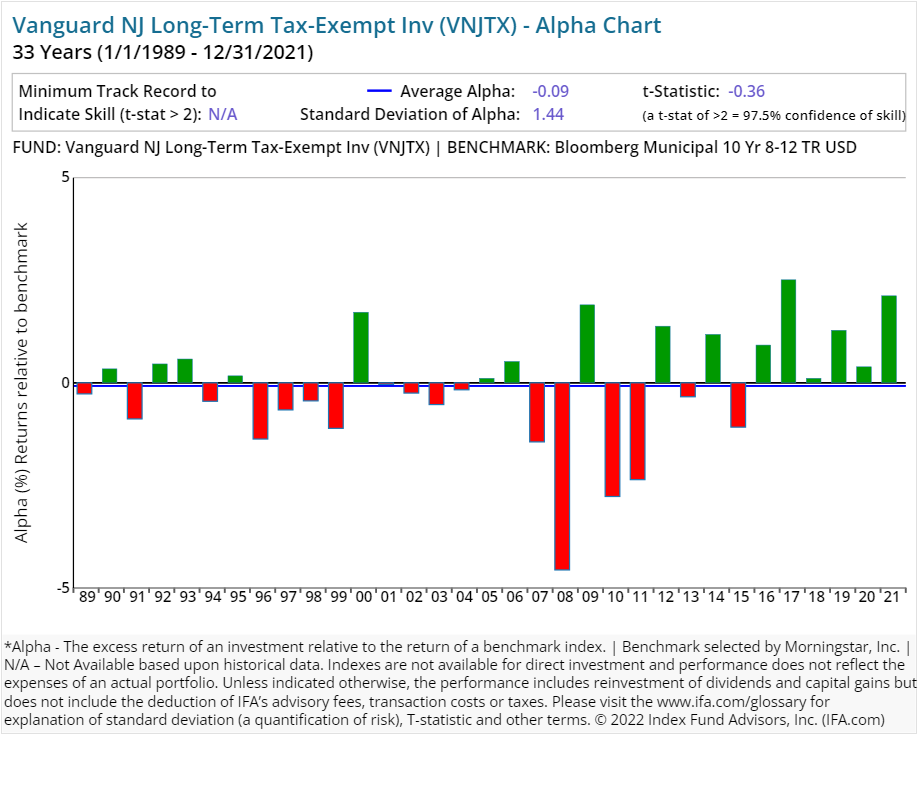

Vanguard S Active Funds A Deeper Look At The Performance

9 Best Municipal Bond Funds To Buy And Hold

Morningstar Taps 2 Vanguard Etfs For Core Bond Exposure Etf Trends

Time To Scoop Up Some Munis Barron S

Vanguard Bond Funds A Smart Way To Reduce Your Dependence On Stocks The Motley Fool

The Worst Funds For Your 401k The Motley Fool

:max_bytes(150000):strip_icc()/GettyImages-463030071-5722c4033df78c56405f298e.jpg)